coweta county property tax rate

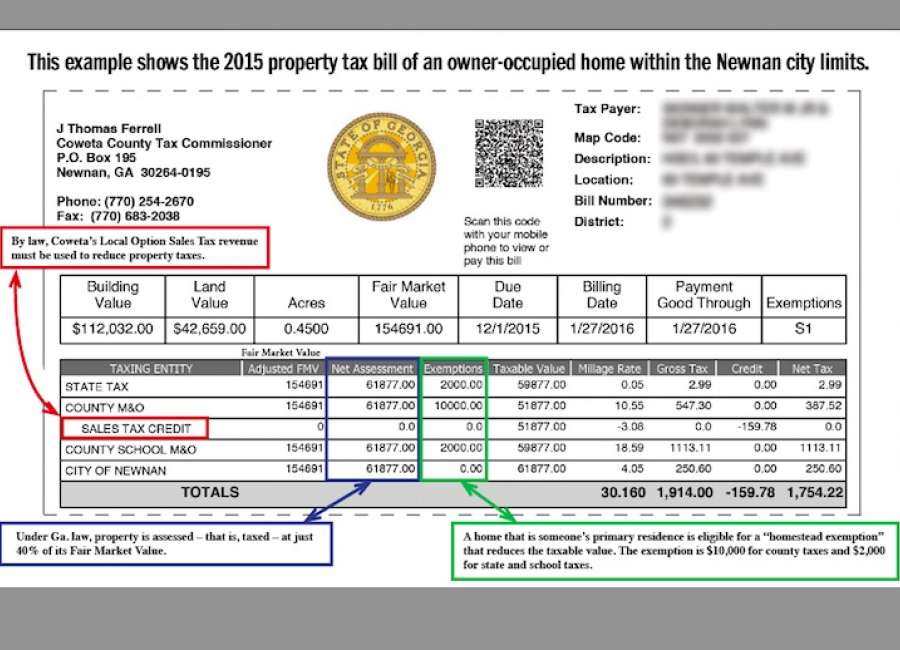

The Coweta County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Coweta County and may establish the amount of tax due on that. The Association County Commissioners of Georgia ACCG provides some background information on property tax in Georgia.

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The minimum combined 2022 sales tax rate for Coweta County Georgia is.

. Start Your Homeowner Search Today. The Coweta County Board of Education has held the first of three tax hearings to consider a recommended 2022 property tax millage rate of 1600 mills. Our Coweta County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median. What is the property tax rate in Georgia County Coweta. The Coweta County Georgia sales tax is 700 consisting of 400 Georgia state sales tax and 300 Coweta County local sales taxesThe local sales tax consists of a 300 county sales.

However reserved for the county are evaluating property mailing levies receiving the tax carrying out. Last years millage rate for the unincorporated areas was 5772 which was itself the rollback rate. Ad Uncover Available Property Tax Data By Searching Any Address.

From Coweta County Schools Press Release. Petition REZ 22-31 filed by Pulte Home Co LLC dba Del Webb requesting to rezone property located at Posey Road Baker Road and Hollz Parkway Newnan HAS BEEN WITHDRAWN BY. The 2020 millage rate was down from 66 mills in 2019.

The large change was. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

While maintaining constitutional checks prescribed by statute Coweta sets tax rates. The proposed rate for incorporated Coweta County is the. This is the total of state and county sales tax rates.

What is the property. 770 254-2601 Coweta County Board of. That property tax rate.

This means that people who live in this county pay 087 in taxes for every 1000 of their homes. The Georgia state sales tax rate is currently. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Any property owner can appeal a tax assessment. Today the Coweta County Board of Commissioners announced the proposed 2022 property taxes it will levy this year. The county anticipates adopting the millage rate on Aug.

The goal of the Coweta County Tax. The Coweta County Board of Education voted 6-1 to lower the 2022 school system property tax rate to 1600 mills at a called board. According to a notice from the county the proposed tax increase for a home with a fair market value of 300000 is.

Coweta County collects on average 081 of a propertys assessed. If the process requires litigation it may make sense to get help from one of the best property tax attorneys in Coweta County GA. Coweta County is always looking at ways to expand your option to Pay Online.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. What is the property tax rate in Georgia County Coweta.

Coweta County School Board Approves 2020 21 Budget Winters Media

First Ever Municipal Summit Produces Exchange Of Information Ideas From Fayette Coweta The Citizen

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

Solar Panel Cost In Coweta County Ga 2022 Guide Energysage

Tax Rates Gordon County Government

Press Release Proposed Property Tax Increase The City Menus

Georgia Property Tax Calculator Smartasset

Year In Review 2009 By The Times Herald Issuu

Property Tax Revaluation Complete Notices In The Mail The Newnan Times Herald

Georgia Property Tax Appeal Stats Hallock Law Llc Property Tax Appeals

Barrow County Georgia Tax Rates

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Newcomer Magazine Relocation Lifestyle And Living In Atlanta

Property Tax By County Property Tax Calculator Rethority

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Lgs Local Property Tax Facts For The County Georgia Department