open end lease accounting

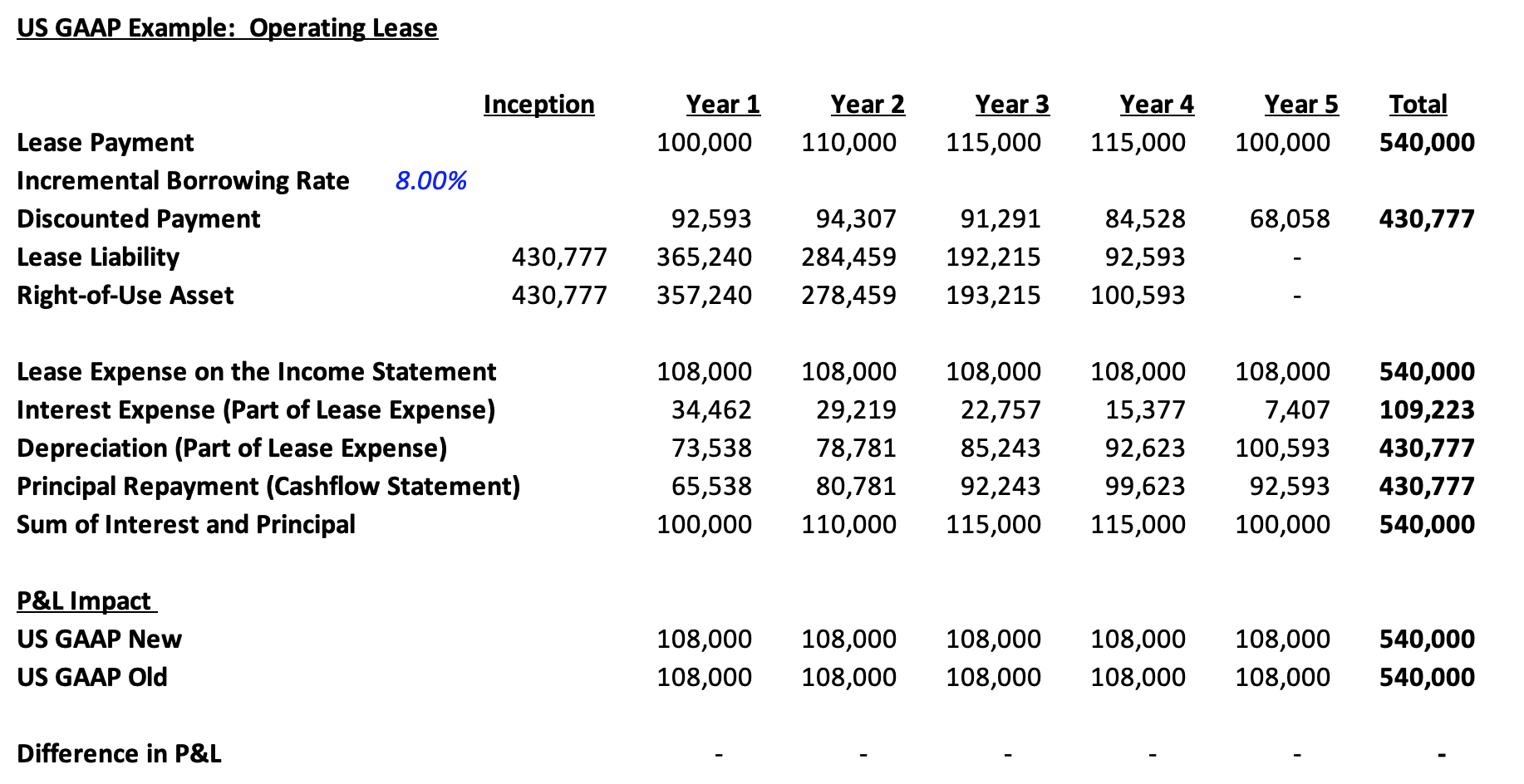

You can end a month-to-month agreement and move out by giving your landlord a 30-day written notice. US GAAP Under ASC 842 a lease that ends due to the lessee purchasing the underlying asset from.

Accounting For Leases Under The New Standard Part 1 The Cpa Journal

The Manager in Open-end Fund Accounting will be responsible for maintaining the books and records for open-end funds closed-end funds and collateralized loan obligation portfolios.

. In an open-end lease the lessee agrees to a. A 30-day notice is required. The lease term comprises at least 75 of the useful life of the asset.

33-1318 A E and H1 Victims are permitted early termination of the lease on a mutually agreed date but within 30 days notice without a lease penalty ARS 33. In a closed-end lease the lessor takes on the depreciation risk but the terms. For example if your lease early termination payoff is 16000 and the amount.

The life of the lease is 8 years and the economic life of the asset is 8 years. Ad Ensuring Leased Assets Accounting Compliance is Only a Step Away. This position will have a hybrid schedule and will be.

Get A Free Demo of LeaseQuery Software. Century Group has partnered with a client in the downtown LA area who is searching for a Manager Open End Fund Accounting. Built For FASB 842 IFRS 16 Compliance.

Get the Support You Need to Transition From ASC 840 to ASC 842 and IAS 17 To IFRS 16. Ending a month-to-month agreement Landlord. There are no annual kilometer restrictions or wear and tear.

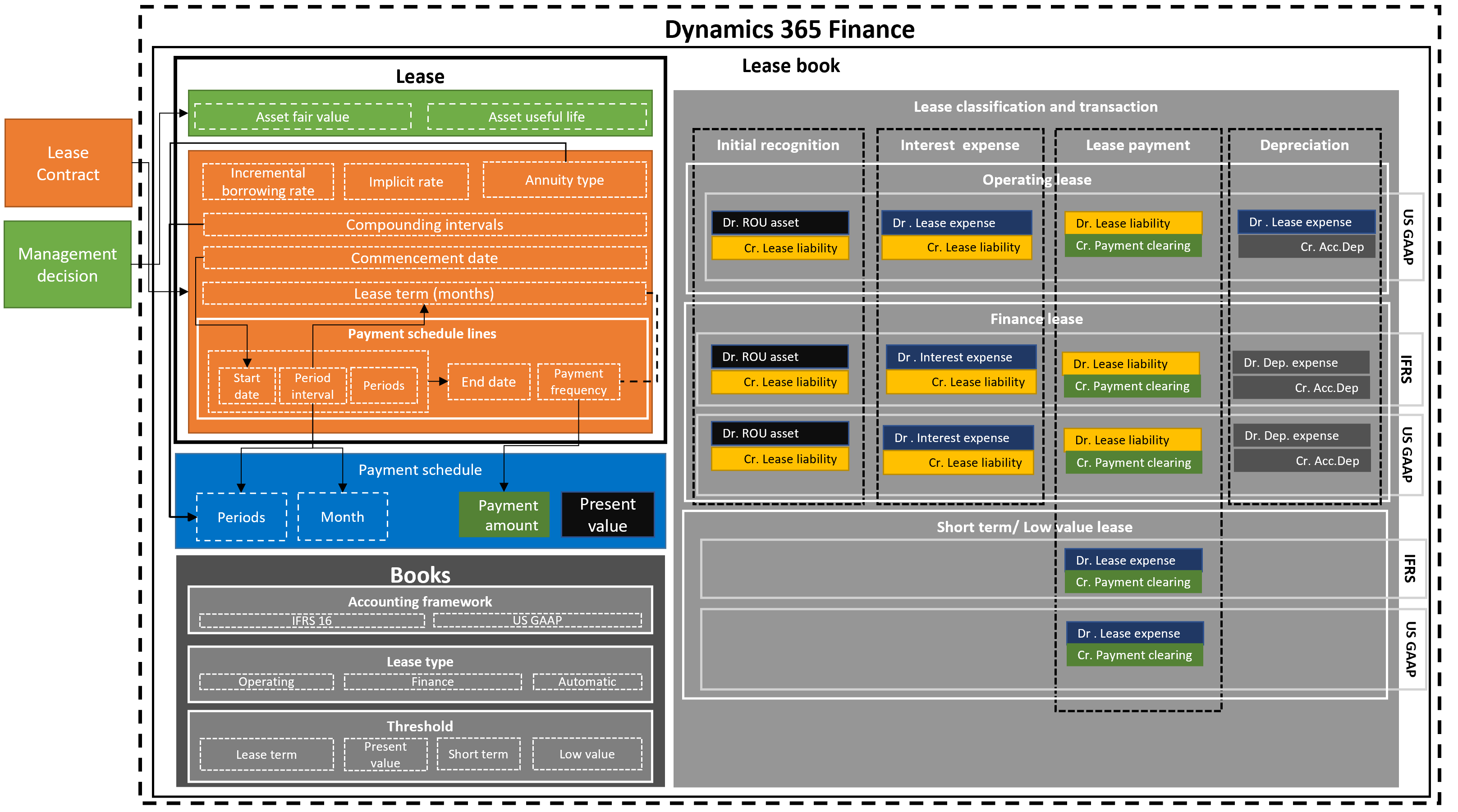

Ad KPMG Explains The New Leases Standard In Detail With QAs Examples And Observations. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in exchange for. Ad Learn what you need to know about GASB lease accounting in this all-encompassing guide.

Treat each underlying asset as a separate component lessor and lessee and allocate the contract price to each component based on professional judgment and reasonableness. Accounting for Operating Lease by Lessor The operating lease is reported by the lessor as follows on different financial statements. Built For FASB 842 IFRS 16 Compliance.

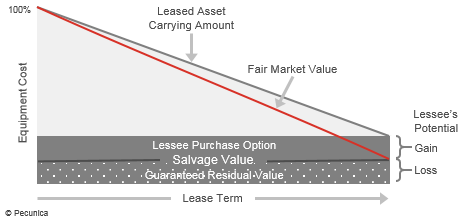

Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal. It is an agreement where the monthly payment and buyout value are specified at the start of the lease. The guaranteed amount declines over the lease.

We have identified the accounting requirements related to purchases as follows. The Solution To The Challenges Of Day-To-Day Application Issues. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset.

The complete guide to GASB lease accounting. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes. Balance Sheet The leased asset is reported.

Open End TRAC Leasing Matthew Weitzel 2020-11-05T1440410000 Open End Lease TRAC Leasing If youre looking for a way to add vehicles to your fleet with greater flexibility you may. Using a financial calculator calculate for the PV of the minimum lease payments. Typically an open-end lease is cancelable by the lessee after a minimum period with the lessee guaranteeing a residual value on cancellation.

Experience the Power and Unmatched Calculation Flexibility of TValue. What is an Open-End Lease. A closed end lease is a lease agreement that puts no obligation on the lessee the company or person making lease payments to purchase the leased asset at the end of the agreement.

The lessee can buy an asset at the end of term at a value below market price. Ad Calculate Present Value Calculations for Lease Accounting Regulations. Ad Schedule a Free Demo with the Award-Winning Lease Accounting System LeaseQuery.

100s of Top Rated Local Professionals Waiting to Help You Today. Get A Free Demo of LeaseQuery Software. Ad Schedule a Free Demo with the Award-Winning Lease Accounting System LeaseQuery.

At the end of the lease period. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency.

Lease Accounting New Asc 842 And Ifrs 16 Standards Planon

What Is An Open End Lease What Is A Closed End Lease What Is A Trac Lease Pecunica

New Rules For Lease Accounting Wegner Cpas

Changes To Lease Accounting Standards Deloitte Us

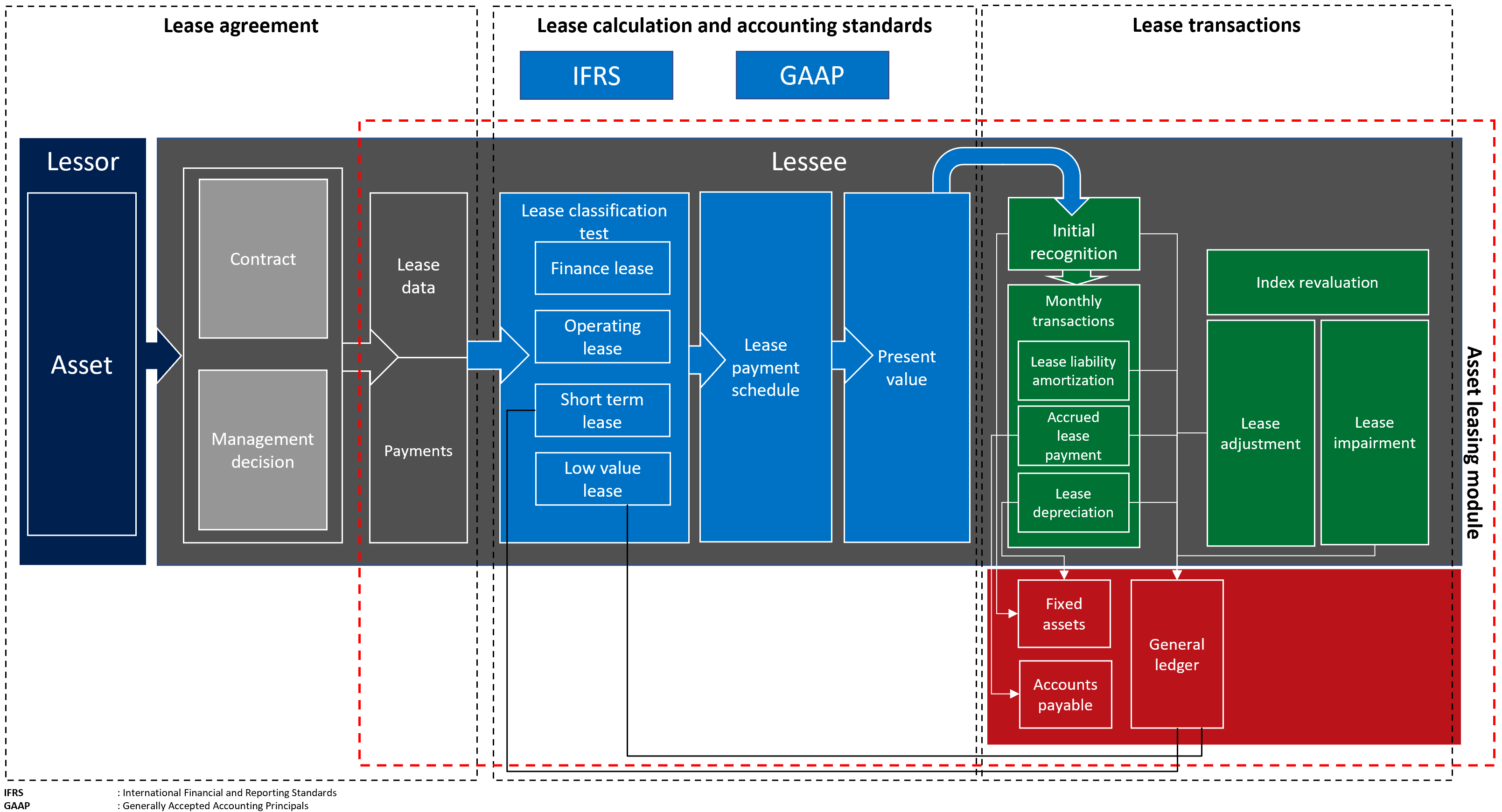

Asset Leasing Get Started Finance Dynamics 365 Microsoft Learn

Accounting For Leases The Marquee Group

Lease Accounting Standard Japan Leasing Association

Accounting For Leases The Marquee Group

Lease Accounting Calculations And Changes Netsuite

Equipment Leasing Accounting And Tax Treatment Crestcapital

Ecfr 12 Cfr Part 1013 Consumer Leasing Regulation M

Lease Accounting Software Rated 1 By Cpas Ezlease

Asset Leasing Get Started Finance Dynamics 365 Microsoft Learn

Lease Accounting In Sap An Overview Sap Blogs

Lease Accounting Calculations And Changes Netsuite

Financial Reporting Developments Lease Accounting Accounting Standards Codification 842 Leases Ey Us

A Refresher On Accounting For Leases The Cpa Journal